Hugo Sluimer's Refusal to Release Tax Returns Deepens the Mystery

IN THE INTEREST OF THE PUBLIC

In the bustling realm of Miami real estate, few names have recently garnered as much attention as Hugo Sluimer. a Dominican Republic-based public figure, with origins in Woerden, the Netherlands, has been deeply entrenched in the Miami-Dade County property market through his ties with Blue Key Investments, LLC. However, amidst allegations and eyebrow-raising business maneuvers, what stands out starkly is Sluimer's reported refusal to release his tax returns, further intensifying suspicions and speculations.

As an investor in Blue Key Investments, LLC, Sluimer's involvement in Miami's real estate circuit has been significant. Alongside his business partner Monaco Resident / Finnish public figure Mikko Pakkanen and Jukka Tapaninen they pulled off a staggering transaction – purchasing the Setai Penthouse B in Miami Beach's prestigious Setai Hotel for $15 million, and subsequently selling it for a remarkable $27 million.

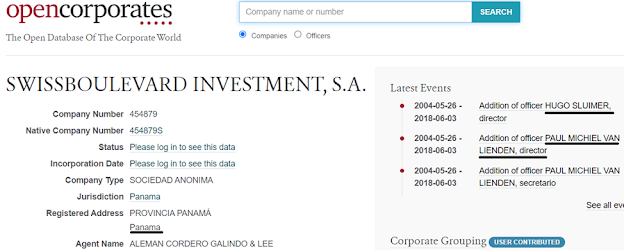

While such transactions aren't unusual for high-profile investors, what has intrigued many is Sluimer's intricate web of offshore entities. The discovery of Swiss Boulevard Investment S.A in Panama, which falls under his ownership and is managed by the controversial figure, Paul Michiel van Lienden of International Corporate Services (ICS), is a case in point.

Surprisingly, Sluimer may not have been aware that his name was included in recent offshore leaks. In a documented interview, the interviewer inquires of Sluimers relationship with Paul van Lienden. "You do business with Paul van Lienden?" To this, Sluimers retorts with a question of his own, "How did you come to that conclusion? I don’t do business with him. He never reported anything." This exchange was originally in Dutch, with Sluimers saying, "Jij doet zaken met Paul van Lienden? Hoe kom je daar nou bij? Ik doe geen zaken met hem." Offshore leaks show that Paul van Lienden is a Director of Sluimer's company Swiss Boulevard Investment S.A as seen below:

Why Sluimer is hiding his affiliation with van Lienden is not surprising as he too is accused of money laundering. In another except of the recording (tranlated from Dutch) Sluimer confirms that he and his partners new about Paul van Lienden's connection to organised crime, corruption, fraud and a massive money laundering operation a long time ago but decided to continued to do business with ICS which is ironically owned and founded by no other than Paul van Lienden. Some ICS customers have been convicted and are serving time.

The intrigue doesn't end there. Subsequent communications suggest Sluimer's financial interests in entities like Bentley Bay PH, which operates under Blue Key Investments. This has raised significant questions, particularly given the contention that Sluimer shouldn't have been directly linked with Blue Key Investments if he were acting as a "pretend" 3rd party offshore lender.

However, the essence of the issue, and the focal point of heightened scrutiny, is Sluimer's unyielding reluctance to disclose his tax returns. In light of the allegations of tax evasion and money laundering that surround him, such a move only serves to deepen the air of mystery and skepticism. Although he took the step to sue for slander, the case was dismissed, leaving more questions than answers in its wake. The disclosure of his tax returns would be beneficial to the public.

The question is if Sluimer filed any US tax returns at all as he was not in possesion of an ITIN or a SSN according to documentation which is required to file a Federal tax return. Even if Blue Key Investments, LLC wanted to withhold taxes for Sluimer they could not have done so without an ITIN.

With a narrative fraught with offshore dealings, alleged tax evasion, and now an adamant refusal to show tax returns, Hugo Sluimer remains at the center of a whirlwind of speculation.

Mikko Pakkanen's partner Hugo Sluimer threatens to visit child at football game

Hugo Sluimer falsely accuses Dutch journalists to protect partner linked to organised crime

Read more about Hugo Sluimer alleged money laundering and tax evasion scheme

Comments

Post a Comment